Illinois Firms

Prioritizing Illinois Businesses

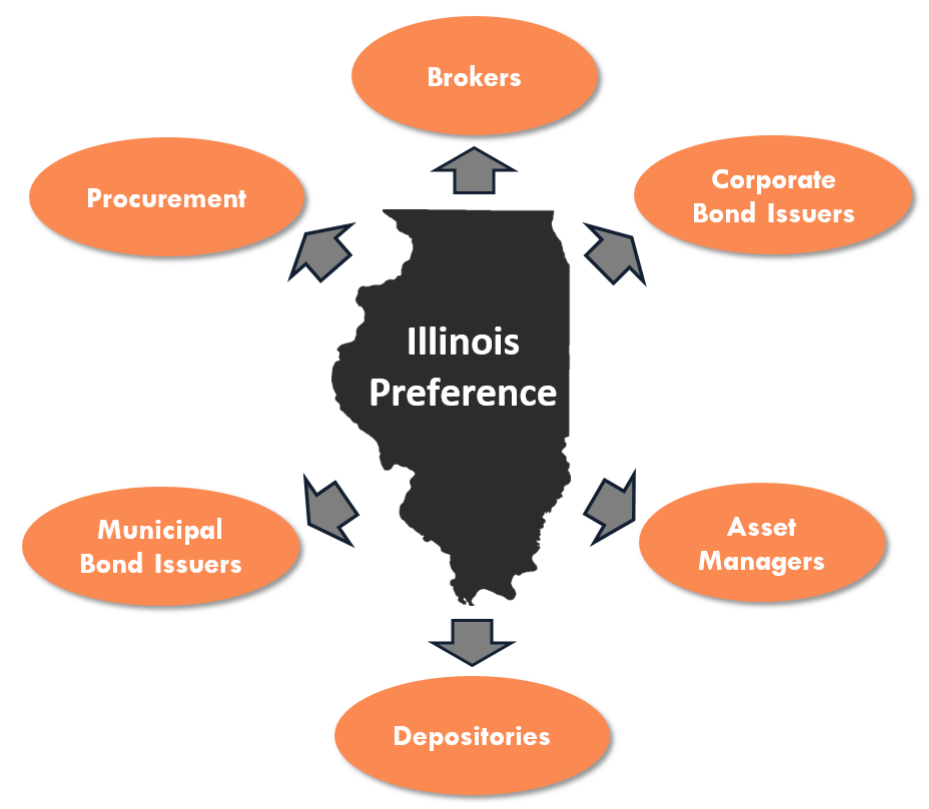

The Office of the Illinois Treasurer has made it a priority to transform the office’s policies and operations to increase opportunities available to businesses headquartered in the State of Illinois.

Illinois is home to a vast array of highly talented, highly capable businesses that offer top-level financial services.

On the investment front, this includes brokerage firms, securities dealers, asset managers, banks, investment consultants, and other financial service providers.

The Illinois Treasurer seeks a wide variety of financial services and products from Illinois firms, including, but not limited to:

Broker/Dealer Services

| Treasuries | Supranationals |

| Agencies | Commercial Paper |

| Foreign Bonds | Municipals |

| Corporate Bonds | Repurchase Agreements |

Investment Management Services

| Fixed Income | Cash & Cash Equivalents |

| Public Equities | Real Estate |

| Private Equity | Venture Capital |

| Securities Lending | – |

Banking Services

| Custody and Safekeeping | Depository Services |

| ACH Transactions | Lockbox Services |

| Cash and Check Processing | Credit and Debit Card Processing |

Other Investment Services

| Investment Consulting | Linked/Time Deposits |

| Bond Arbitrage | Third-Party Research |

Procurement Opportunities

For non-investment related opportunities, including RFPs, RFIs, invitations to bid, and other related areas, please visit our Procurement Opportunities page.

Contact the Treasurer’s Investment Team

Illinois-based firms are encouraged to download and submit this Capabilities Questionnaire, which provides the Illinois Treasurer with a resource to be proactive in identifying business opportunities with Illinois-based firms. For other questions on business opportunities, Illinois-based firms can contact Investments@illinoistreasurer.gov.

Policies

- RFP Process – All RFPs now provide points in the scoring process to Illinois-based applicants.

- Preference for Illinois-Based Investment Firms – Policies and procedures establish uniform operating processes across investment divisions for the allowance of preference to qualified Illinois-based firms.

- Illinois Growth and Innovation Fund – Launched the Illinois Growth and Innovation Fund, a $1.5 billion evergreen impact investment fund that invests in ways that attract, assist and retain quality tech-enabled businesses in Illinois.

- Investing in Illinois Communities through Municipal Bonds – The Illinois Treasurer seeks to purchase high-rated bonds from Illinois municipalities, thereby giving communities the funds they need to grow while generating added yield for the State.

- Investing in Illinois Businesses through Corporate Securities – The Illinois Treasurer actively purchases various securities issued by Illinois-based companies, including, but not limited to, corporate bonds, commercial paper, and repurchases agreements. This enables the State to invest in businesses with operations in Illinois while earning a high-yielding return.

- Illinois Business Liaison – Staff are specifically deployed to assist Illinois firms in doing business with the Illinois Treasurer. Contact Investments@illinoistreasurer.gov.

Results

- Illinois-Based Asset Managers – Increased from $406 million in January 2015 to $2.0 billion as of June 2023. Track these results on The Vault.

- Illinois-Based Broker/Dealers – Illinois-based firms brokered $89 billion on behalf of the Illinois Treasurer in FY 2023. Track these results on The Vault.

- Illinois Growth and Innovation Fund – The Illinois Growth and Innovation Fund (ILGIF) invests in ways that attract, assist and retain quality tech-enabled businesses in Illinois. ILGIF aims to invest $1.5 billion on a recurring basis, creating an estimated 60,000 jobs per investment cycle. The investment is expected to attract more than $2 billion in additional private-sector money. Since inception, ILGIF has already supported over 5,000 jobs, generated over $25.4 billion of invested capital in Illinois companies, and contributed to $38.2 billion in GAAP revenue. Learn more at www.ILGIF.com.

- Purchased approximately $208 million in municipal bonds from Illinois communities (as of June 2023)