Freedom of Information Act

Introduction

Under the Illinois Freedom of Information Act (“FOIA”), 5 ILCS 140, certain records in possession of public agencies may be copied or inspected upon request. Public records under FOIA are “all records, reports, forms, writings, letters, memoranda, books, papers, maps, photographs, microfilms, cards, tapes, recordings, electronic data processing records, electronic communications, recorded information, and all other documentary materials pertaining to the transaction of public business, regardless of physical form or characteristics, having been prepared by or for, or having been or being used by, received by, in the possession of, or under the control of any public body.” 5 ILCS 140/2(c).

Some records and information, however, are exempt from disclosure via FOIA. These types of records are generally described in Section 7 of FOIA, 5 ILCS 140/7. Records may also be subject to confidentiality provisions imposed by other statutes or governing authority.

Short Summary of Purpose

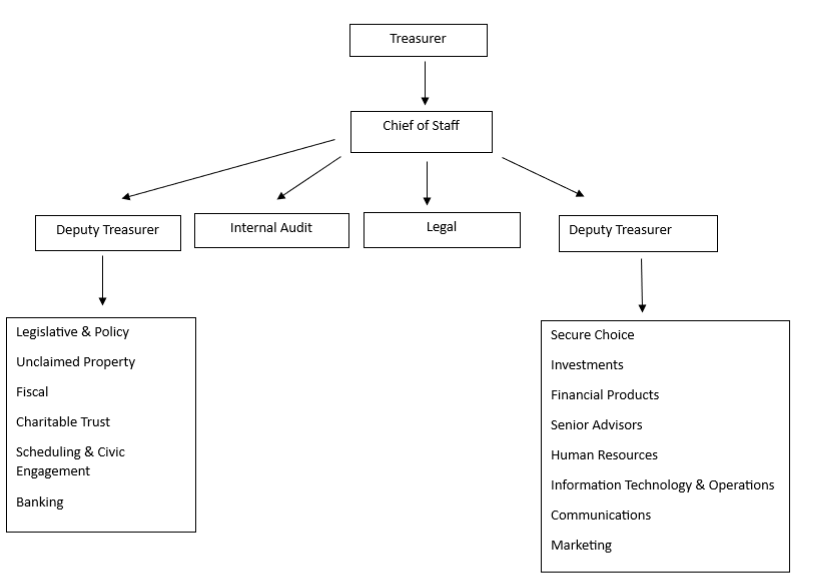

The State Treasurer is the constitutional officer responsible for the safekeeping and investment of the State portfolio and disbursement of funds upon order of the Comptroller. The Office of the State Treasurer (“Treasurer”) administers numerous programs, including the following: two college savings plans qualified under Section 529 of the Internal Revenue Code; a local government investment pool; an electronic payment system for state and local units of government; a linked deposit program; and the collection and distribution of unclaimed property reported to the State of Illinois.

Total Amount of Operating Budget: Total FY24 Operating Budget: $46,395,140.00

Number and Location of Offices: 8 total offices at the following locations:

Chicago – General Springfield – Executive Office

555 W. Monroe Street, 14th Floor Capitol Building, 219 Statehouse

Chicago, IL 60661 Springfield, IL 62701

Marine Bank Building Champaign Regional Office Building

1 East Old State Capitol Plaza 2125 South First Street

Springfield, IL 62701 Champaign, IL 61820

Marion Regional Office Building Peoria County Health Department

2309 West Main Street 2116 North Sheridan Road

Marion, IL 62959 Peoria, IL 61604

Rock Island County Building E.J. Zeke Giorgi Center

1504 Third Avenue 200 S. Wyman Street, Suite 307

Rock Island, IL 61201 Rockford, IL 61101

Number of Employees: Approximately 190 full-time employees and no part-time employees.

Boards and Commissions

Pursuant to Section 4(a) of FOIA, please find below “the identification and membership of any board, commission, committee, or council which operates in an advisory capacity relative to the operation of the public body, or which exercises control over its policies or procedures, or to which the public body is required to report and be answerable for its operations.” Various other boards that may govern or advise on other programs and investments undertaken by the Office of the State Treasurer, can be found elsewhere on this website.

Office of the State Treasurer Personnel Review Board

- Elba Aranda-Suh

- Susan Georgelos – Pending confirmation

- Jo Johnson – Pending confirmation

Pursuant to the State Treasurer Employment Code (15 ILCS 510), the Personnel Review Board carries out duties as provided in the State Treasurer Employment Code.

Office of the State Treasurer Travel Control Board

- G. Allen Mayer – Chief of Staff

- Deborah Miller – Chief Financial Officer

- John Renick – Chief Information Officer & Director of Operations

Pursuant to the Section 12-1(a)(9) of the State Finance Act (30 ILCS 105/(a)(9)), the Travel Control Board within the Office of the State Treasurer creates policies for travel, and approves any exceptions thereto, for the Office of the State Treasurer.

How to Submit a FOIA Request

To request information of the Treasurer under FOIA, please submit your request in writing. You may use the form at this link for a FOIA request: FOIA Request Form

Any FOIA request may be mailed to:

Office of the Illinois State Treasurer

ATTN: FOIA Officer

Office of the Illinois State Treasurer

1 East Old State Capitol Plaza

Springfield, IL 62701

FOIA requests may also be sent via email to FOIA@illinoistreasurer.gov. Please consider using a subject line other than “FOIA request” to distinguish your request from others.

While you are not required to use the provided form, please include the following information on any written request: the phrase “Freedom of Information Act” or “FOIA”; a specific description of the type of records sought; and contact information for the requester, including a telephone number or email address.

The Treasurer stores certain records electronically. The Treasurer also stores electronically data related to things like investments and account balances. The Treasurer generally responds to requests made under FOIA electronically. However, upon request, the Treasurer will cooperate with any requester in an effort to ensure information and records stored electronically can be obtained in a form comprehensible to persons lacking knowledge of computer language or printout format.

FOIA Rules and Costs

The Treasurer’s FOIA rules, including a schedule of costs, are codified at 2 Ill. Adm. Code 651. Black-and-white copies in excess of 50 pages may be charged at a rate of $.15 per page.

Immediate Resources

Popular requests to the Treasurer include information relating to procurement and unclaimed property. Many such records are available through this website without the need for a FOIA request. Information regarding procurement may be obtained at the “Procurement” link on this website. Publicly available information regarding unclaimed property may be obtained at the “iCash” link on this website.

Categories of Records

Other categories of records under the control of the Office of the State Treasurer include the following:

- Bond statements and related records for bonds issued by the State of Illinois

- Bank statements and related correspondence used to reconcile State accounts

- Investment statements and related correspondence used to reconcile State investment accounts

- Accounting reports and application forms related to savings and investment programs outlined elsewhere on this webpage

- Correspondence and Calendars

- Procurement files and Contracts

- Meeting Minutes

- Other general and miscellaneous office correspondence and other records

Authority

This website information is provided as required by Section 4 of FOIA, 5 ILCS 140/4, and may be revised as necessary.

Public information regarding unclaimed property claims is available on our I-Cash database; however, total property values are withheld until a claim form is received. The Treasurer is legally prohibited from providing additional information about unclaimed property other than to government agencies acting to return the property and to persons who appear to be the owner of the property or otherwise have a valid claim to the property, see 765 ILCS 1026/15-102(5) & 1401(b).