About Illinois Secure Choice

The Illinois Secure Choice Savings Program (Secure Choice) provides workers with an easy way to save their own money for retirement and is simple and straightforward for employers to facilitate.

Businesses that had at least 5 Illinois employees in every quarter of the previous calendar year, that have been in business for two or more years, and that do not currently offer or contribute to a qualified retirement plan must either begin offering a qualified plan, or automatically enroll their employees into Secure Choice. Secure Choice is also available to individuals who choose to sign up separately from an employer, including self-employed individuals.

Secure Choice participants are enrolled in a default target date Roth IRA with a default five percent payroll contribution, but can choose to change their contribution level or fund option at any time, or choose to opt-out of the program altogether. Accounts are owned by individual participants and are portable from job to job.

Employers register for the program, provide employee information so accounts can be created, and facilitate payroll contributions. However, unlike a traditional retirement plan, employers are not considered plan fiduciaries, do not pay any fees, do not make contributions into the accounts, and are not responsible for plan paperwork or administration.

Secure Choice is run by a seven-person Board with Treasurer Frerichs serving as Chair. The Treasurer’s Office administers Secure Choice on behalf of the Secure Choice Board and partners with private-sector financial service firms for recordkeeping, custodial, and investment management services.

Program Overview

The Secure Choice Savings Program Act [820 ILCS 80] establishes a retirement savings program to be administered by the Secure Choice Board for the purpose of providing retirement savings options to private-sector employees in Illinois who lack access to an employer-sponsored plan. The Secure Choice Savings Program officially launched in 2018 with a phased implementation based on employer size as outlined below:

As of June 30, 2025, Secure Choice has over 157,000 participants who together have saved over $250 million for retirement. More than 27,000 employers, representing all 102 counties in Illinois, are registered for the program.

For more information, visit our program website at www.ILSecureChoice.com. You can also find the program contact information below:

- Employer Assistance: (855) 650-6913

- Employee Assistance: (855) 650-6914

- Email: clientservices@ilsecurechoice.com

Secure Choice - Fox and Hounds Salon & Spa

Secure Choice - The Dearborn Restaurant

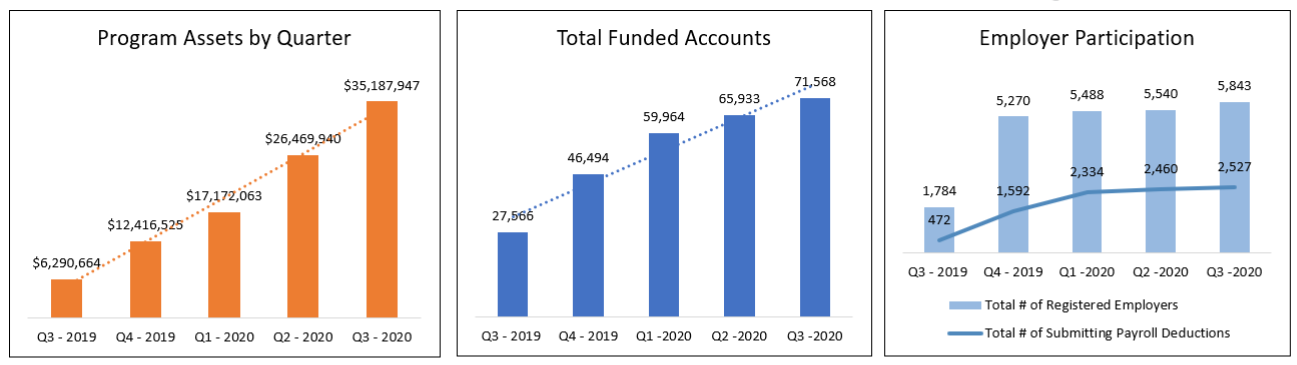

Program Performance Dashboards

Monthly & Quarterly Dashboards are available to you on the Performance Dashboards Page. They provide more details on the Illinois Secure Choice Program's performance in the areas of asset and account growth, saver contributions and withdrawals, and employer engagement and participation.

*A snapshot of 2020 Q1 Program Performance (Data as of March 31, 2020). You can access the monthly and quarterly dashboards via the link above.

Illinois Secure Choice Savings Board

The Illinois Secure Choice Savings Board ("Board") is responsible for the governance, organizational and financial oversight of the Illinois Secure Choice Program. The Board holds quarterly meetings that are open to the public. If you are interested in learning more about the Board, its policies and rules, or viewing Board meeting materials, you can access them at the Board Page at any time.