The FIRST Fund

Why Invest in Infrastructure and Real Estate?

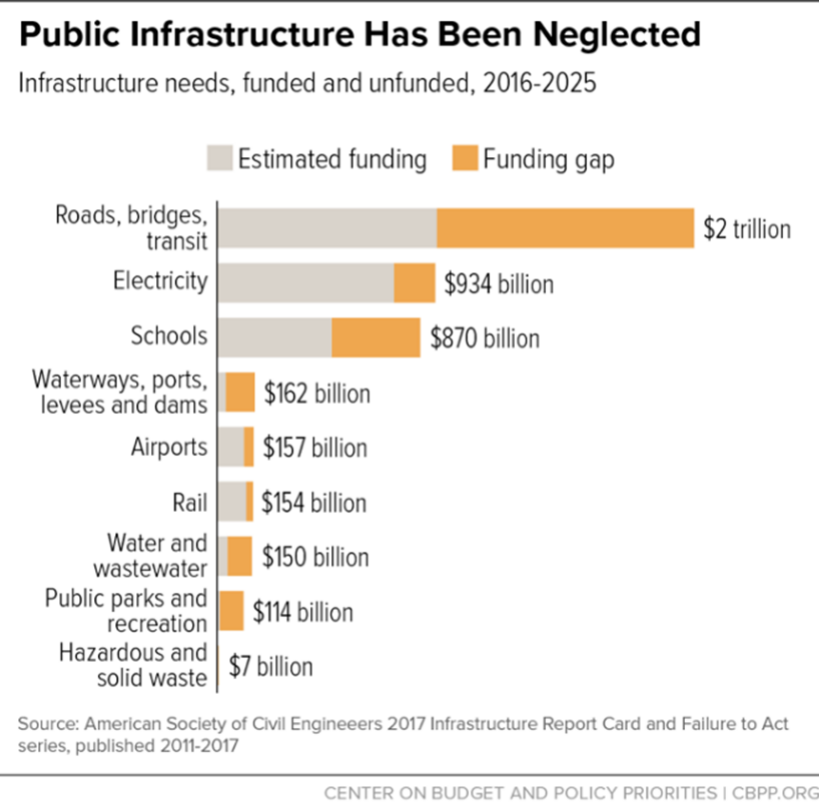

Infrastructure is the backbone of our daily lives and communities. Physical structures like roads, bridges, airports, electrical grids, schools, housing, and hospitals are essentials in a successful and prosperous society; however, capital spending in infrastructure has fallen in recent decades across the United States.

Within the State of Illinois, the percentage change of spending in infrastructure as a share of gross domestic product (“GDP”) dropped 0.62% from 2002 to 2016[1]. Deferred maintenance backlogs at state facilities and educational institutions alone have reached $24 billion in the State – one of many reasons the American Society of Civil Engineers rated Illinois’ infrastructure as a C- in 2018 [2]. We see this as a risk for the State and an opportunity to invest in ways that better position the State while improving the quality of life for our citizens.

Investment in local infrastructure can produce a plethora of benefits for the state from access to food, clean water, broadband, healthcare, and quality education, to buttressing our communities against environmental disaster. National efforts have already been put in place to increase spending on a federal level. Coupled with the passing of the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, the FIRST Fund is equipped to support and strengthen these efforts in Illinois. Through the FIRST Fund, we aim to help bridge the gap in Illinois between the need for innovative infrastructure projects in Illinois and availability of local financing for these projects.

Background

Established by Illinois Treasurer Michael W. Frerichs, the FIRST Fund is a first-of-its-kind, evergreen, $1.5 billion impact investment fund dedicated to building and strengthening Illinois’ infrastructure and real estate.

Legally named the Infrastructure Development Act, the act was proposed by Illinois Treasurer Michael W. Frerichs to address the need for investment within the state of Illinois. The authority allows for the Illinois State Treasurer to allocate up to 5% of the State portfolio to invest in, create, and maintain infrastructure and real estate assets within the state through Illinois infrastructure development firms. Infrastructure firms must maintain a significant presence in Illinois as defined in the bill and have a track record of development in Illinois [3].

Why “FIRST” Fund?

When the authority was signed into law, it opened the door for a new type of infrastructural impact fund and paved the way to be the first State Treasury to launch a real assets fund dedicated to local economic development.

Illinois has a rich history of achieving various firsts: the first state to open a franchised McDonald’s location; the first experimental nuclear reactor was created at the University of Chicago; the world’s first Ferris wheel was unveiled at the 1893 World’s Columbia Exposition; and Illinois is part of one of the original US highway systems (Route 66). At the Treasurer’s Office, we strive to continue this tradition of firsts by launching innovative programs with high return potential, sustainability-centric, and a focus on diversity, equity, and inclusion.

With the creation of the FIRST Fund, Illinois now houses the first state-run real assets fund dedicated to local economic development. We wanted to name our fund for what it is – the “first” of its kind. One of our main priorities is to drive sustainable development within Illinois, support and encourage fair wages and benefits for workers employed by managers, contractors, and subcontractors – all while producing a market return. The Treasurer believes that an adequately compensated and trained worker delivers a higher quality product and service.

Equally important to our office is continuing to promote diversity, equity, and inclusion, and create opportunities for all of Illinois’ citizens. True economic development is inclusive and all-encompassing. We will invest with a focus toward promoting local minority, woman, veteran, or persons with disabilities (MWVD)-owned or managed investment firms, as well as encouraging investment into and partnership opportunities with quality local diverse-owned stakeholders and communities in the Illinois development ecosystem.

With FIRST Fund, Illinois will set the blueprint for what it takes to successfully approve, launch, and execute a real assets program with sustainability, diversity, and local development in mind. This fund will prioritize the interests of our state and our people, driving investments into resilient development projects while creating inclusive opportunities for all Illinois residents. Through FIRST Fund, the Treasurer will position Illinois as the nation’s premier state in terms of infrastructure quality, access, and resilience.

FIRST Fund Investment Objectives

Through the FIRST Fund, the Treasurer’s Office will partner with investment firms that deploy capital into Illinois development projects. Desired outcomes for the FIRST fund include but are not limited to:

- Local Impact: Investing with a unique regional focus, enabling financial returns while supporting investments that grow the local economy and generate additional impact in the State through improved infrastructure and high-quality job creation. All funds that we invest in are required to invest 2x our commitment amount to the fund into Illinois-based projects to ensure our capital is recycled and has the intended impact in Illinois.

- Investment Diversification: Expanding the pool of assets in which the State Investment portfolio can be invested to diversify the portfolio, mitigate risk, and increase State investment earnings potential.

- Sustainable Investments: Encouraging sustainable development while also improving financial outcomes.

- Diversity and Inclusion: Expanding the manager pool, diversifying investor perspectives, and meeting the needs of all communities to promote more equitable and inclusive infrastructure development within the State of Illinois.

- Worker Centric: The Treasurer believes that an adequately compensated and trained worker delivers a higher quality product and service. Through the Treasurer’s Responsible Contractor Policy, the office supports and encourages fair wages and fair benefits for workers.

The Treasurer’s Responsible Contractor Policy is available here.

FIRST Annual Report

Each year the Illinois Treasurer publishes an Annual Report highlighting investment activity, economic development, progress on bolstering local infrastructure and real estate, and future initiatives for the coming year for the FIRST Fund. The below report highlights all pertinent areas over the prior calendar year.

2023 FIRST Annual Report

FIRST Investment Policy

The FIRST Investment Policy is designed to ensure that the Illinois Treasurer, as well as any contractors the Treasurer retains to provide services related to FIRST, take lawful, prudent, and effective actions while supporting FIRST. The Investment Policy is designed to allow for sufficient flexibility in the management oversight process to take advantage of investment opportunities as they arise while setting forth reasonable parameters to ensure prudence and care in the execution of FIRST.

Please click here to access the FIRST Investment Policy.

Partnerships to Date

RockCreek serves as Investment Advisor to the Treasurer’s Office advising on opportunities and strategy for the FIRST Fund. RockCreek is a leading global investment firm that applies innovation, data, and technology to sustainable investing. With $15 billion in assets and decades of experience investing in the energy transition, health, education, mobility, affordable housing, and fintech, RockCreek partners with university endowments, foundations, pension plans, sovereign funds, and family offices to generate long-term value, seek differentiated returns, and make business and financial models more inclusive and sustainable. RockCreek’s private markets team invests in early-stage, growth, and late-stage companies, and its Outsourced Chief Investment Officer (OCIO) and multi-asset class teams invest in hard-to-access opportunities, emerging talent, and co-investments with leading partners.

Contact

Infrastructure or Real Estate Fund’s with a track record of investing in Illinois assets, should reach out to FIRST@Illinoistreasurer.gov.