Supporting Small Business Growth in Underserved Communities

The Invest in Illinois – Business Loan Guarantee Program (“Program”) helps small businesses in low-income communities overcome barriers to traditional financing. Through strategic partnerships with approved financial institutions (“Lenders”), the program provides loan guarantees to qualified small businesses in low-income communities, defined as geographic areas that have a poverty rate of at least 20 percent.

Program Highlights

- Offers loan guarantees of up to 25% for eligible small business loans

- Focuses on businesses located in Low-Income Communities—defined as areas with a poverty rate of at least 20%

- Financial institutions may qualify for up to $1,000,000 in loan guarantees

- Designed to help small businesses that may not meet traditional lending requirements

- A one-time, non-refundable fee of $1,000 is required from financial institutions to participate in the Program

- Download the Business Loan Guarantee Program Flier for more information

How Financial Institutions Can Apply

Step 1: Become a Participating Lender

To offer guaranteed loans through this Program, financial institutions must first be approved by the Illinois State Treasurer’s Office.

If you’re already an approved Lender in the Loan Guarantee Program, you can proceed directly to Step 2.

Step 2: Submit a Business Loan Guarantee Application

Once approved, participating Lenders have 30 days from the date of approval to submit their Business Loan Guarantee Application(s).

Frequently Asked Questions

The Invest in Illinois-Business Loan Guarantee Program works with Participating Financial Institutions to provide loan guarantees to small businesses located in low-income communities throughout Illinois.

For Lenders

To become a Participating Lender in the Invest in Illinois – Business Loan Guarantee Program, your financial institution must complete and submit a Lender Participation Application. The Illinois State Treasurer’s Office reviews and approves all applications.

The program helps small businesses in low-income communities get access to financing when traditional loan options may be limited or unavailable.

To qualify as a Participating Lender, your financial institution must:

- Be insured by the FDIC or NCUA

- Have a CRA rating of Satisfactory or Outstanding

- Have an IDC rating of 75 or higher

- Complete and submit a Lender Participation Application

- Be authorized to conduct business in Illinois with a presence in Illinois

Yes. Lenders must pay a one-time, non-refundable $1,000 participation fee.

Lenders determine the percentage of the loan that is guaranteed. However, the maximum guarantee allowed is 25% of the loan amount.

Each loan guarantee is available for up to 5 years. Lenders may choose to remove the guarantee earlier at no penalty.

To qualify, a business must:

- Have fewer than 500 employees at the time of application

- Be located in a low-income community

The following businesses are not eligible for the program:

- Investment real estate businesses

- Tobacco product businesses

- Adult entertainment businesses

- Gambling businesses

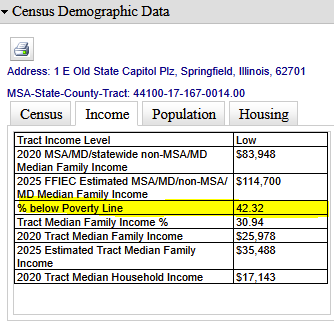

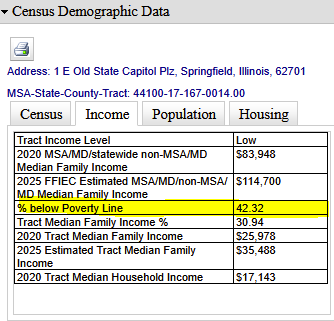

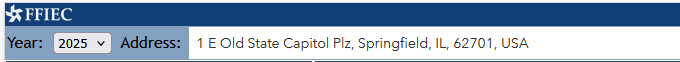

Use the FFIEC Census Date Tool to verify:

- Go to the FFIEC Geocoding System

Enter the business address

- Click “Census Demographic Data”

- Review the “Income” tab and check the “Below Poverty Line.”

For Small Business Owners

To qualify, a business must:

- Have fewer than 500 employees at the time of application

- Be located in a low-income community

Businesses in the investment real estate, tobacco products, adult entertainment, and gambling sectors are not eligible to participate in the Program.

No. The Treasurer’s Office partners with Lenders on this Program. Businesses must apply through a participating Lender, who will work with the business to submit the Business Application for the Program. To find a participating Lender in your area, contact us at investinillinois@illinoistreasurer.gov.

To find a participating Lender in your area, contact us at investinillinois@illinoistreasurer.gov.

Use the FFIEC Census Date Tool to verify:

- Go to the FFIEC Geocoding System

Enter the business address

- Click “Census Demographic Data”

- Review the “Income” tab and check the “Below Poverty Line”