FUND TO THE ILLINOIS FUNDS

ePAY participants have the opportunity to earn greater returns on their balances and enjoy immediate access to their monies as part of The Illinois Funds, a Standard & Poor’s AAAm rated Local Government Investment Pool (LGIP). The Illinois Funds lets government agencies use the Treasurer’s resources to safely invest their funds while enjoying economies of scale available from a $4-6 billion pooled investment portfolio. The Illinois Funds’ investment objectives are, in priority order: (1) safety of principal, (2) maintaining sufficient liquidity to ensure participants have immediate access to funds, and (3) providing a competitive rate of return relative to comparable investment options.

Key Benefits:

- Complete Account Access - Free online account access to view transaction history, perform financial transactions, including account inquiries, transfers, purchases, and redemptions.

- No Minimum Balance Requirement

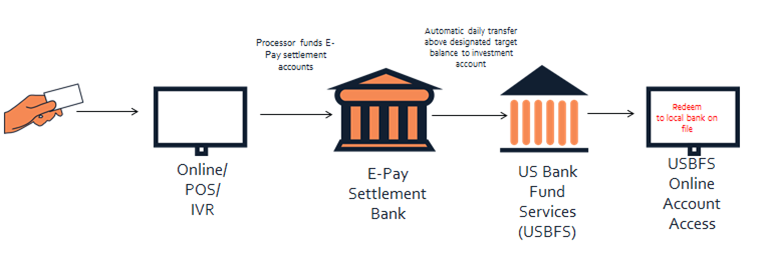

- Automatic Deposits - Government agencies participating in ePAY under The Illinois Funds will have their funds deposited into their Illinois Funds investment account(s) daily. In addition to same day processing of Comptroller distribution payments.

How it Works